Solar Tax Rebate

The introduction of the much-anticipated residential solar rebate has finally arrived in South Africa. However, it's essential to be aware that specific regulations, rules, and limitations apply to this rebate program.

While many South Africans stand to benefit from this promising legislation, it's important to note that not all will qualify for the program.

This article will provide a comprehensive breakdown of how the system operates, who meets the eligibility criteria, and an overview of the regulations, expectations, and limitations that apply.

Eligibility

Eligibility is a critical factor for anyone interested in the Solar Panel Rebate in South Africa. To qualify, individuals must be tax-paying residents, whether they contribute through PAYE or as a provisional taxpayer. PAYE contributors can apply during the 2023/2024 tax filing year, while provisional taxpayers can claim the rebate on their provisional and final payments.

It's important to note that this rebate is solely for residential properties, and not for businesses. The primary function of the premises must be residential to be eligible.

Sectional title holders may also benefit from this rebate program, provided they meet the installation requirements and can install solar panels on their sectional title. However, body corporates are not eligible to claim this rebate as it's only available for individual persons.

Rebate Information

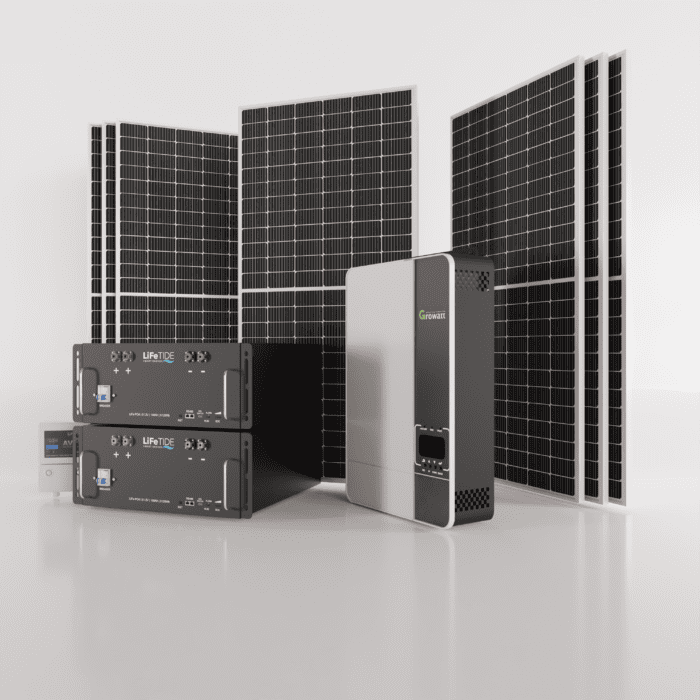

The Solar Panel Rebate program in South Africa has specific guidelines for the equipment covered. Only unused, fixed solar panels are eligible for this rebate. Inverters and batteries are not included, as they can be used without solar panels, which is not in line with the program's objective to encourage additional generation capacity. Portable solar panels and diesel generators are also not covered by this rebate.

It's important to note that there is a one-year window for purchasing and installing solar panels. Only brand-new solar panels with a minimum power rating of 275W purchased and installed between 1st March 2023 and 29th February 2024 will be considered for the rebate.

The rebate amount is capped at 25% of the total cost of the solar panels, with a maximum claim amount of R15,000.00 per person. If the 25% rebate amount exceeds the R15,000.00 maximum payout, individuals will only receive R15,000.00.

Businesses are also eligible for tax incentives when investing in renewable energy projects. As of 1 March 2023, businesses can claim a 125% tax deduction on qualifying investment costs for a period of two years. There is no limit to the qualifying cost of these investments, meaning that businesses can claim a cost plus 25% allowance on the total cost incurred on renewable projects in the year they were incurred. This is a significant development that aims to encourage the uptake of renewable energy in South Africa and support businesses in their transition to sustainable energy sources.

Requirements

- Brand-new, unused solar panels

- Either added to an existing system or a new installation.

- Minimum solar panel capacity: 275W

- Installed at a residential or commercial property

- Your solar system must be connected to the mains of the property.

- Bought and installed between the 1st of March 2023 – the 29th of February 2024

- A certificate of compliance indicating that the solar panels were installed for the first time between the one-year period shown above.

- A VAT invoice for the solar panels only.

- A proof of payment